Retirement planning challenges keep stacking up. As we roll into 2021, for some the planning is complicated by late-career job loss, medical emergencies, COVID restrictions or being part of the “sandwich generation” (supporting your children AND aging parents).

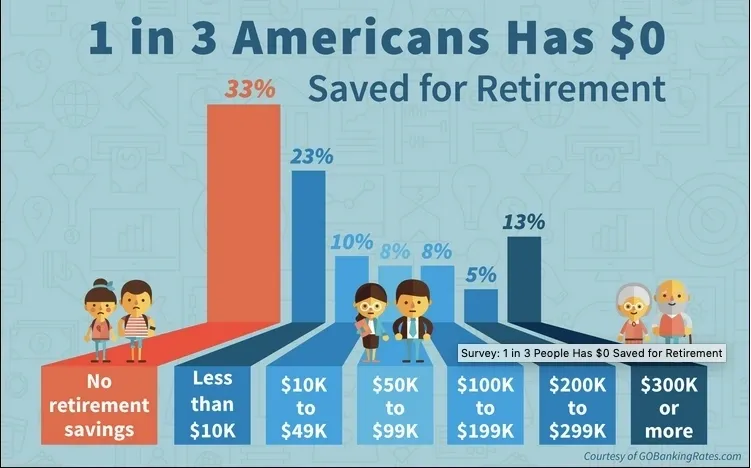

Retirement savings: 1 in three have none.

It’s not uncommon for aging baby boomers to feel overwhelmed by a likelihood they may need to stay in the workforce far longer than “normal” retirement age of 65. Millions don’t believe they will ever be able to stop working and enter full-retirement.

For millions of American, a late start to retirement planning brings a cold reality: If you’re just getting started and you’re 55+, the chances of saving your way to retirement security are greatly diminished. There aren’t enough saving opportunities (years) or compounding multipliers to get you to the stratospheric expense estimates required to not outlive your savings.

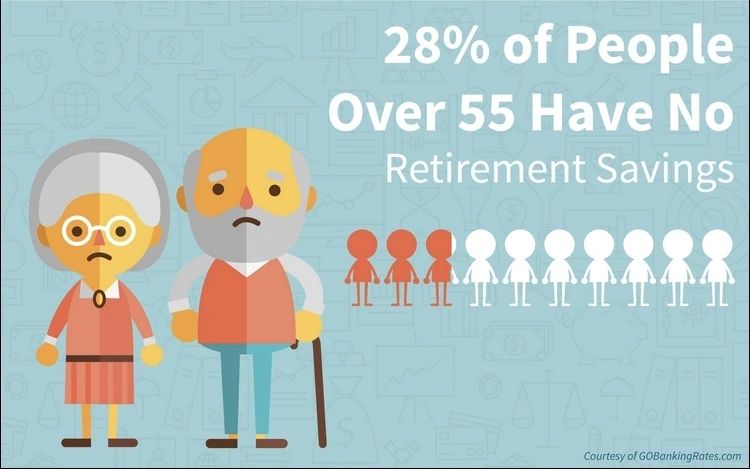

28% of Americans over age 55 have zero retirement savings

But let’s not lose site of the basic calculus of retirement: income and savings represent only one side of your financial ledger. There’s the equally important expense side. For many, it’s forecast expenses that looms daunting. It starts with an existential guesstimation: how long will we live?

You can take one of two roads here:

– assume that COVID is a statistical blip and forecast that we’ll all live longer, or

– accept that your genes or lifestyle diminish your likelihood of becoming an octogenarian.

Either way, you’ll come up with a number of remaining years that are foundational to any living expense calculation.

From this number we jump to more familiar terrain of annual expenses. If your life is rooted in staying in the 50 states, you’ll have an idea about your annual expenses, but still need to make adjustments for lifestyle changes induced by retirement, real estate downsizing and of course healthcare costs.

Your healthcare outlay after age 65 is where so many of us get tripped up. The leading cause of US bankruptcy is inability to cover medical expenses. Can you imagine the devastating double-whammy of failing health combined with bankruptcy!

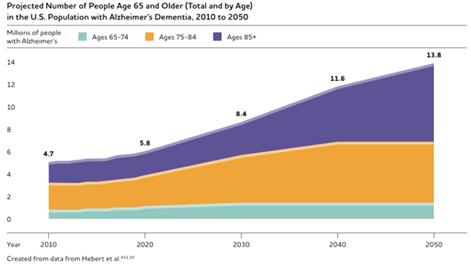

Long term care projections are startling. The website, alz.org reported in March of 2018 that the lifetime cost of care for a person with Alzheimer’s stood at $341,840. Families bear 70 percent of that cost through out-of-pocket expenses and the value of unpaid care.

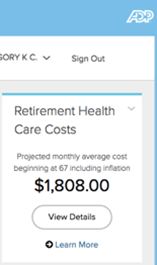

US payroll giant ADP calculates a monthly (after insurance) out-of-pocket of over $1,800 from age 67 onward.

ADP retirement healthcare costs, 2018

ADP retirement healthcare costs, 2018Using the ADP figure (let’s use $3,000 for a couple), that’s an astounding $36,000 for just out-of-pocket medical expenses — per year! Do the math for 20 years (with inflation), and you’re needing (by this ADP estimate) to earmark close to $1,000,000 from either income or a savings source.

Who on a social security or a pension sees this as a viable future? What’s an American adult to do?

The bottom line for many boomers is this: with later-in-life savings shortfalls, the expense side of your retirement math just doesn’t add up. Very, very few Americans can “save their way” ahead, especially when the care cost egg is bigger than the nest itself.

Fortunately, the expense side of your retirement IS manageable, but requires some research and soul searching. Or even perhaps a lifestyle migration solution — one that’s helping thousands of Americans find sustainable senior living futures.